The Method To Use Quickbooks Desktop For Payroll Management

We know that running payroll for the very first time could be fairly intriguing, however, after a while you may find it easy, easy, and seamless to make use of. We hope that the data supplied on this article is sufficient for you to know all there’s about arrange Payroll in QuickBooks. Still, in case you have any confusion, you probably can reach out to our Dancing Numbers skilled staff. Our team has the best knowledge and experience to handle such technical queries. They have been coping with such issues for a really lengthy time and could be your information all the way in which.

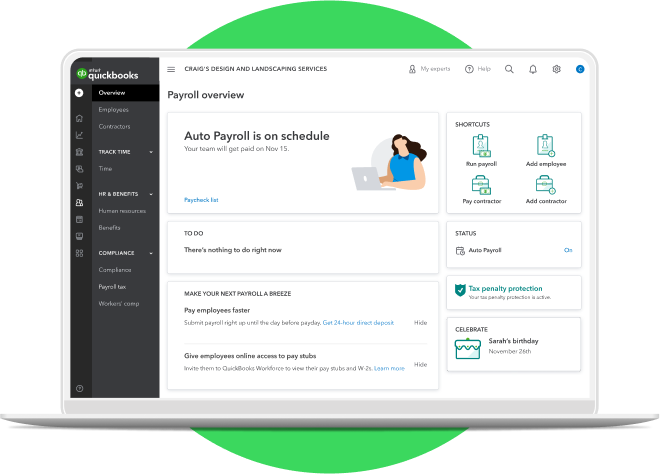

Merchant Maverick’s scores usually are not influenced by affiliate partnerships. If you’re already a fan of QuickBooks Desktop, it doesn’t harm to give QuickBooks Desktop Payroll a shot. For QuickBooks Desktop users, the obvious benefit is that QuickBooks Desktop Payroll integrates with the software. This makes setting up the software program straightforward, and users with prior QuickBooks experience will find the payroll dashboard straightforward to navigate and use. QuickBooks Desktop Payroll does not embrace any HR companies or add-ons. However, the software does help integrations with a few of the best HR software on the market, which can be used to consolidate your business’s essential knowledge.

In this section, you will need a while primarily based on the variety of employees you should make payments for and the number of checks which would possibly be generated. To arrange the wanted tax payments, you should navigate to the Scheduled Cost column. Now you’ll witness several varieties of payments that are listed there. In the given description column, the payment frequency may be changed by choosing the Edit option. Now you could be required to enter the pay charges along with the working schedules of the particular workers.

Payroll Software Evaluate Methodology

Lastly, when you plan to supply direct deposit, nows the time to get employee consent and collect their banking info. It’s a part of operating your small business legally—according to state legal guidelines and the Fair Labor Requirements Act (FLSA). QuickBooks facilitates the administration of a broad range of benefits, together with retirement plans and health insurance. For correct deductions, inputting the proper contribution quantities for every worker is crucial.

Step 2: Evaluate Your Payroll Data

Sustaining current payroll tax tables is crucial to make sure correct tax calculations and compliance. These various advantages make it necessary to reactivate payroll subscription QuickBooks Desktop and assist you to save time and money. At BundleCricut.com, we offer reasonably priced QuickBooks Desktop licenses that embrace full payroll functionality, permitting businesses to deal with payroll tasks smoothly.

The Complete Guide To Getting A Free Square Card Reader For Your Business

- Working payroll may look like a giant task, however whenever you break it down step by step, it turns into rather more manageable.

- Payroll consultants are hypothetically available for necessary issues, but getting to at least one and talking issues through can take a very lengthy time.

- The steps to activate rely upon when you bought it on-line, by phone, or from a retail store.

BundleCricut.com offers real QuickBooks Desktop licenses that embrace full payroll features, ensuring your small business has the tools needed for correct and environment friendly payroll management. Incorrect payroll calculations can happen if worker particulars like pay charges, hours labored, or tax settings aren’t entered accurately. Double-check the employee’s pay sort, deductions, and tax settings to confirm everything is accurate earlier than processing payroll. Proper record-keeping is essential for payroll compliance and audit functions. QuickBooks Desktop permits you to save payroll records inside the software program for straightforward entry and retrieval.

QuickBooks Desktop is an costly choice for the features promised, and you will get extra bang in your buck elsewhere. With the charges of such types of taxes being already set, there might be payroll in quickbooks desktop no requirement for users to consider rates and numbers. Nevertheless, it is not possible to edit such kind of tax or expense account or modify how it’s proven on paychecks.

If you’re already accustomed to QuickBooks, QuickBooks Desktop Payroll will seem acquainted and simple. QuickBooks Desktop Payroll works with locally-installed QuickBooks Desktop accounting software. Yes, you can use QuickBooks payroll for a 30-day trial earlier than making the fee. This will let you discover its features and performance without making a long-term commitment. As Soon As more benefit of this trial is you could join it and verify whether or not it meets your small business wants or not. They generally comprise the most recent adjustments to rules and tax varieties or security fixes and enhancements to the software program.

The software guarantees adherence to tax and financial reporting regulations by minimizing the likelihood of human error in computations. With payroll gadgets set, QuickBooks Desktop will automatically calculate wages and deductions throughout https://www.quickbooks-payroll.org/ each pay period. QuickBooks Desktop Payroll rated a strong four.1/5 star rating within the critiques class which displays its users’ positive experiences with the software program.

This course of helps the government monitor employment for issues like youngster support enforcement and forestall fraud claims for unemployment benefits and public assistance. A rudimentary understanding of prevalent payroll errors in QuickBooks can avert processing inaccuracies during payroll transactions. By integrating time monitoring or human assets software program with QuickBooks, operation processes could be streamlined, and a extra comprehensive view of the enterprise could be obtained. QuickBooks allows the generation of personalized stories that furnish valuable insights about payroll expenditures, employee on-costs, and tax obligations. Reviewing these payments to determine their alignment together with your organization’s payroll obligations is crucial. Once you are carried out with this process, you can move on to make the most of the payroll characteristic.

QuickBooks Desktop Payroll Enhanced customers can invite new employees to finish their onboarding by way of the QuickBooks Workforce self-setup portal. This cloud-service function is available via the QuickBooks payroll Setup Wizard. The QuickBooks Desktop system has all the time had a powerful reporting system, and the Desktop Payroll service is no completely different. Users can create customized payroll reviews or choose from the built-in payroll report templates.