The Method To Arrange Fee On A Web Site: Suggestions + Issues 2025

It’s additionally price testing GoCardless for straightforward financial institution funds, notably if you’re a charity requiring one-off and repeat donations, since it makes use of Direct Debit. We will schedule a quick consultation call to go over the way you’re at present handling service provider providers and current a proposal for free of charge. Meet one of our payment processing consultants to see if working together is smart. Evaluating these choices aids in choosing the best cost answer for your corporation needs. With CDGcommerce, your pricing plan will rely in your gross sales quantity and whether or not or not your business is taken into account high-risk. HMS has a lot to offer different on-line companies as well, as the corporate will provide a fundamental web site at no further value and can work with your corporation to match you to the shopping cart that fits your wants.

Process less than that, and a payment service provider with flat-rate pricing like Square/Stripe/Shopify Payments could also be a greater deal for you. By selecting one of the best accounts payable tools, businesses can expect ROI by way of reduced processing costs, quicker invoice approvals, and improved money circulate visibility. By adopting one of the best accounts payable platforms, firms additionally reduce handbook errors and achieve efficiency. Partnering with sturdy AP automation vendors further boosts accuracy and scalability.

Paypal

- General, Adyen is great for customized options where you need a lot of affect within the type and fee move of on-line transactions.

- PayPal-owned Braintree Funds is a cost gateway supplier that provides merchant accounts and flat-rate cost processing, with an easy setup course of.

- We’ll cowl what to search for in small business fee options, how each platform compares, and the way Lessn offers a unique way to flip your payments right into a strategic benefit.

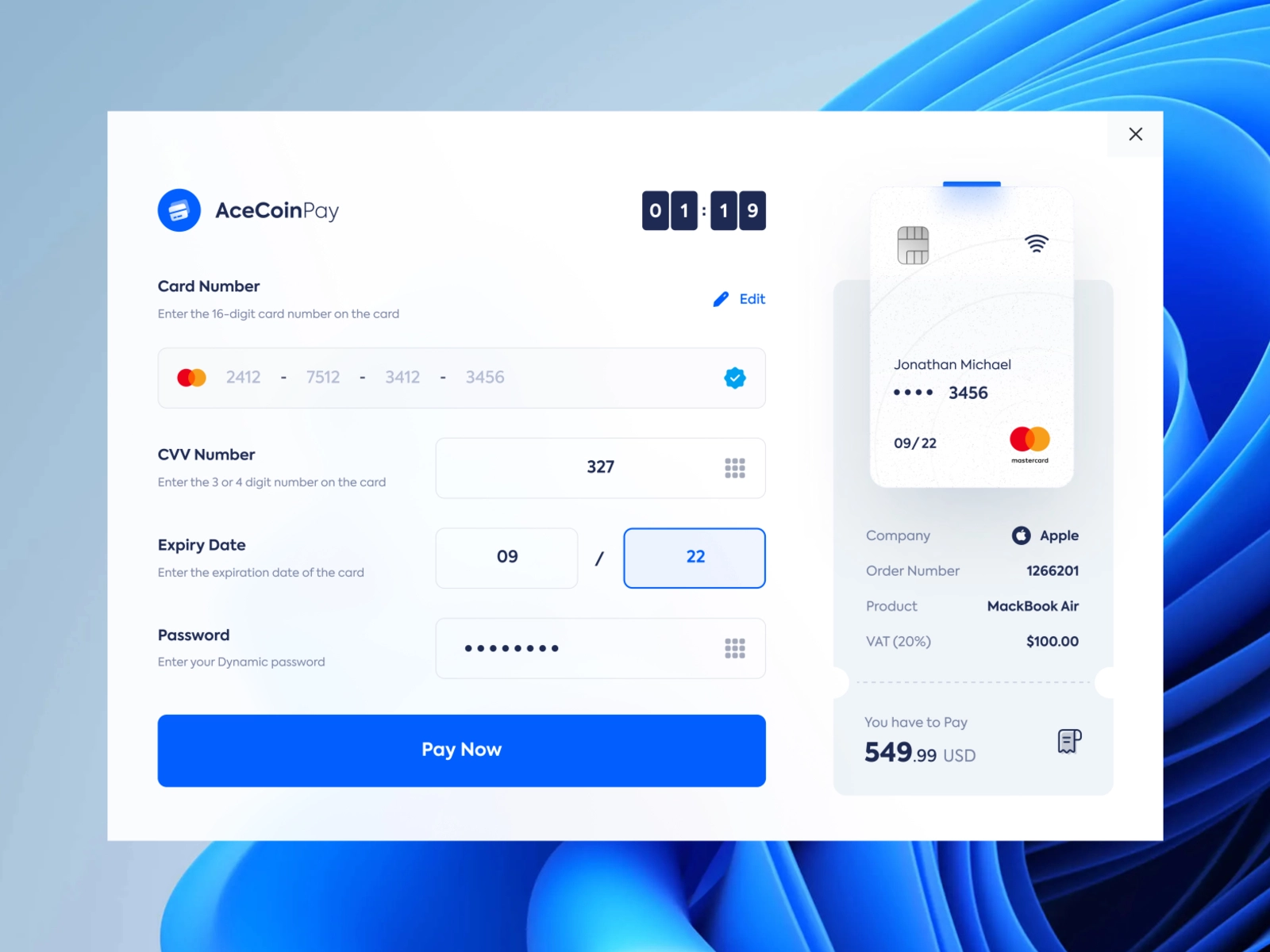

- As Quickly As you’ve chosen a payment gateway supplier and opened a service provider account, you’ll have to get an API key from your provider to add to your web site or app.

2Checkout’s system is built for high-growth and large online businesses, but charges are fairly steep for card transactions. You’ll want to really benefit from the worldwide gross sales tools and optimisations that the platform excels in to justify the fees. With Adyen, you cannot easily set up payments with out some degree of technical know-how.

Provide your pricing information to let shoppers choose their companies before viewing an up-to-date on-line bill with the flexibility to pay proper there and then. In addition, a HoneyBook Necessities or Premium account can connect with your QuickBooks On-line account. This integration enables the platform to automatically sync your funds into your QuickBooks account, making it straightforward to manage all your accounting in one place. Here https://www.quickbooks-payroll.org/, we’ll take a look at 5 of the preferred small enterprise payment platforms in addition to 5 additional choices for more particular wants. Choosing the best small enterprise fee answer performs a significant position in bettering how your small business runs daily.

Make certain you possibly can cowl the prices of subscriptions while still making a profit—and double-check that decrease transaction charges with an added subscription really save you money. A chargeback is when a buyer disputes a transaction, and cost service suppliers charge you to investigate it. Many payment techniques, like Shopify Payments, operate as both payment gateways and cost processors.

For small businesses handling international transactions, Payoneer stands out as the best small enterprise fee processor because of its cost-efficient international fee payment platforms for small businesses solutions and straightforward setup course of. Importantly, a gateway doesn’t truly transfer the money into your bank account. Nonetheless, many trendy providers bundle gateway, processing, and even service provider account providers into a single platform, so that you don’t have to piece everything collectively yourself. Fee processing fees for a small enterprise usually value between 1.5% and 3.5%, with an added cost as a fixed proportion or dollar quantity. For instance, Shopify Payments expenses 2.5% to 2.9% plus 30¢ for online funds. To know which is greatest for you, calculate your monthly sales quantity and anticipated payment processing costs.

How We Select The Most Effective Cost Processing Corporations

Skip prolonged third-party activations and go from setup to selling in a single click on. Shopify Payments comes together with your Shopify plan, all you should do is turn it on. The Forbes Advisor Small Enterprise group is dedicated to providing unbiased rankings and data with full editorial independence. We use product knowledge, strategic methodologies and expert insights to tell all of our content material to guide you in making the most effective choices for your corporation journey.

You can provide free trials, recurring payments and subscriptions, or enable your clients to create a profile that shops their purchase historical past and cost info. Past this, Stripe accepts 135+ currencies and an impressive 100+ fee strategies, including Google Pay and Apple Pay. If you promote online and have an international viewers, Stripe could be worth it despite its high transaction prices. You can accept payments in tons of how too, such as QR codes, pay-now hyperlinks, donations and subscriptions, which is a great option when you have recurring patrons.

If you’re a freelancer or unbiased business proprietor who must charge frequently for companies, HoneyBook stands out among the greatest fee processing corporations for small companies. Yes, HoneyBook provides a web-based fee portal — you’ve received that covered — however it’s additionally an all-in-one clientflow platform that allows you to manage the entire strategy of promoting and delivering your providers. If you’re on the lookout for easy integration and a high stage of customizability, Stripe makes running an internet storefront a total breeze within the “getting paid” department. It also provides good customer assist, but it doesn’t embrace fraud protection for small companies. Instead, Stripe Radar is a separate function that you have to add to protect towards fraud.

Stax seems to face important criticism from its customers, with quite a few complaints about unresponsive and ineffective customer support, sudden charges and difficulties in canceling providers. Many customers report points with delayed or withheld funds and describe the overall experience as frustrating, main some to hunt authorized action. Hosted gateways are hosted by the supplier, and so will redirect your clients to its personal platform to make a fee. These are the simplest form of fee gateway to set up, but a drawback is that clients must go away your website to pay – which may result in cart abandonment. The transaction charge jumps as much as 2.8% for any international or commercial card, so if your corporation will take a massive quantity of payments from overseas, you’ll really feel the pinch.

80+ years of mixed experience covering small enterprise and personal finance.